Dashboard and Analytics Business Process Automation at Your Fingertips

By Admin on 23 February 2021

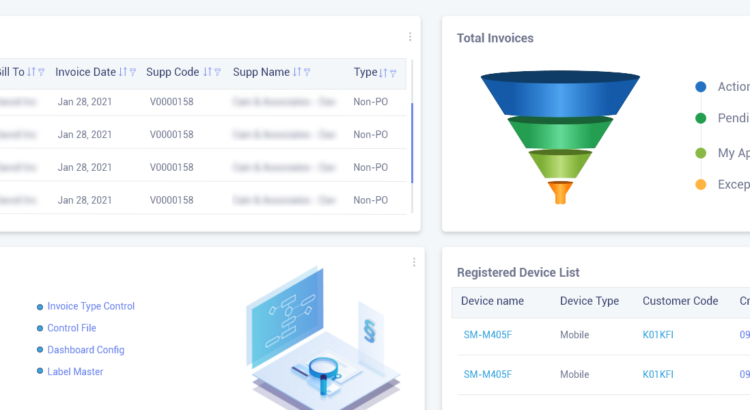

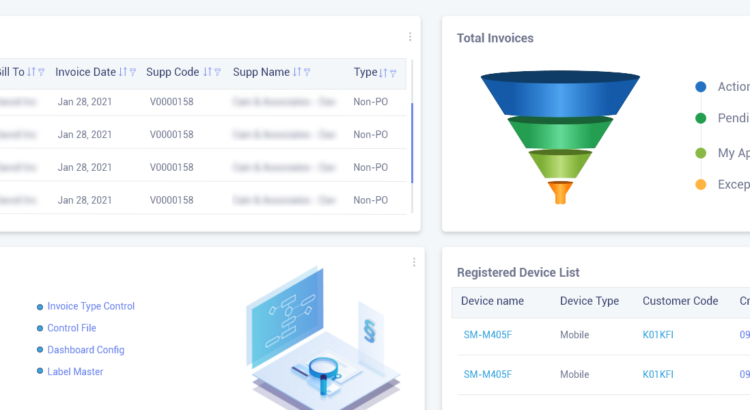

The dashboard on an AP Automation suite allows businesses to get access to automation tools at their fingertips. Processes such as inventory updates and workflow can be automated using rules within the system. Additionally, invoices can be quickly reported to keep track of revenue. AP software, such as ARISTAXPRESS and NetSuite, offer their own benefits from the dashboard. They support electronic invoicing and automatically capture the data within invoices to update the system seamlessly.

The dashboard is a powerful resource for businesses since it allows them to have a single point of control for their automation processes. Depending on a particular business’s automation needs, a company can choose what to automate and what to keep as manual. The overall goal would be to ensure full Automation, but there will always be a need for a manual check on automation processes. Audits can be done directly from the dashboard as well. However, as useful as the dashboard is, its real power lies in leveraging an AP Automation suite’s analytics engine.

Forbes notes that as many as 59% of all enterprises utilize analytics in some capability. Analytics serve as the inputs for making relevant decisions that may impact the business significantly. Analytics engines are crucial to improving efficiency within a system. Accounts payable functionality runs into several challenges, including:

AP Automation analytics can give real-time insight into a business’s processes, unlike anything else. By asking the right questions, management can garner answers to improve their system immensely. Among the core benefits that AP Automation analytics can offer a business are:

Overall, both customers and vendors start to see a business in a better light once their AP processes are improved. Companies don’t need to worry about missing invoices and having creditors showing up months later demanding payment. Analytics allows businesses to be smarter with their liquid assets and improve the workflow of their AP processes. If you’re ready to explore what AP Automation can do for you, and how dedicated services such as ARISTAXPRESS or NetSuite can improve your operational efficiency, please contact us today!